Deciding whether to rent or buy a home is a significant decision, especially in a dynamic market like Calgary. This guide will break down the costs and benefits of both options to help you make the best choice for your situation.

Renting in Calgary

Renting a home can offer flexibility and lower upfront costs. Here are the typical costs associated with renting a home in Calgary:

- Monthly Rent: $2,100

- Monthly Renter’s Insurance: $30

- Annual Rent Increase: 3%

Renting might be the right choice if you value mobility or are not ready to commit to the long-term responsibilities of homeownership. However, renting comes with its own set of financial considerations and potential downsides.

Buying in Calgary

On the other hand, buying a home can be a substantial financial investment but also offers long-term benefits. Let’s look at the financial aspects of purchasing a home:

- Home Price: $350,000

- Down Payment: 20% ($70,000)

- Interest Rate: 5.125%

- Loan Term: 30 years

- Points: 1% ($3,500)

- Closing Cost for Buying: $1,500

Additional Homeowner Costs

Owning a home includes several additional expenses:

- Annual Property Taxes: 1.25% ($4,375)

- Average Monthly Maintenance: $125

- Monthly Homeowner’s Insurance: $100

- Annual Home Appreciation Rate: 4%

- Other Monthly Costs (e.g., Association Dues): $50

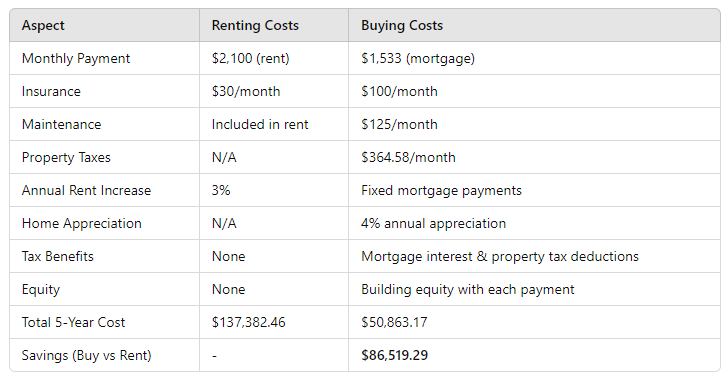

Financial Comparison: Renting vs. Buying

By buying a home, you could save an impressive $86,519.29 over the next five years compared to renting. Here’s how:

1. Building Equity:

Every mortgage payment you make increases your equity in the home, turning your monthly payments into an investment rather than an expense.

2. Appreciation Benefits:

Homes in Calgary are expected to appreciate at a rate of 4% annually, increasing your net worth significantly over time.

3. Tax Advantages:

Homeowners can benefit from tax deductions on mortgage interest and property taxes, reducing overall tax liability.

4. Stable Payments:

With a fixed-rate mortgage, your monthly payments remain stable, unlike rent, which typically increases by 3% annually.

5. Cost Savings Over Time:

While renting may seem cheaper initially, the long-term savings from buying a home add up, leading to substantial financial benefits.

Conclusion: Should You Rent or Buy in Calgary?

The decision to rent or buy in Calgary ultimately depends on your financial situation, lifestyle preferences, and long-term goals. Renting offers flexibility and lower initial costs but lacks the long-term financial benefits of homeownership. Buying a home requires a significant upfront investment but provides stability, equity growth, and potential savings over time.

Consider your current financial situation, future plans, and the local housing market trends in Calgary to make an informed decision. If you’re ready to explore home buying, consulting with a real estate professional can provide valuable insights and help you navigate the process.

Looking to Buy or Rent in Calgary?

Contact us today to explore your options and find the perfect home that fits your needs and budget.

Follow Us for More Real Estate Insights:

Stay updated with the latest trends, tips, and market news by following our blog and social media channels.